When a $0 Medication Costs $11.99

This morning’s reminder that healthcare advocacy never takes a day off came courtesy of a prescription of aspirin.

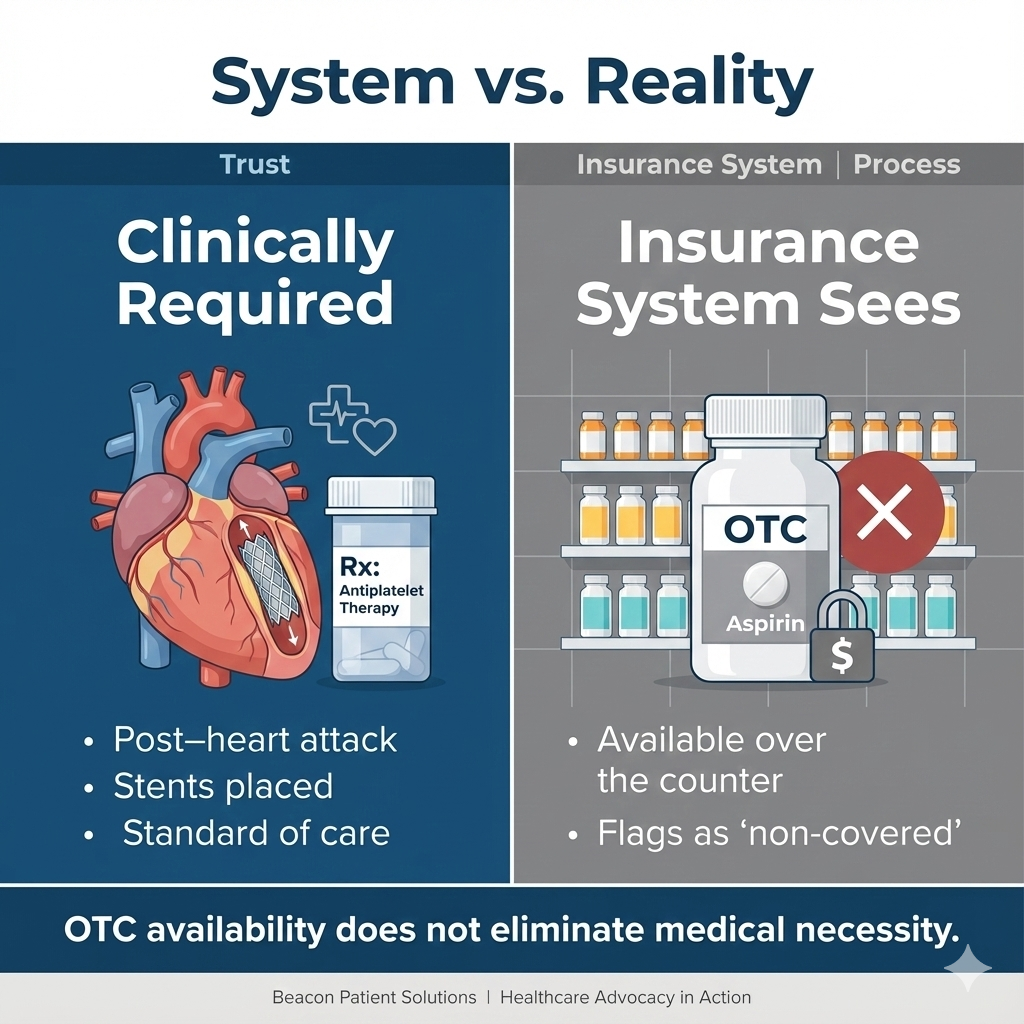

What makes this more than an inconvenience is context. On January 6 of this year, I had a heart attack. I required stents, and aspirin is not optional. It is a critical, lifelong part of my post–heart attack care and stent maintenance. This is not a “nice to have” medication. It is standard-of-care, evidence-based secondary prevention.

I went to the pharmacy to pick up my routine refills, including my prescribed aspirin, a medication I will take for the rest of my life. I’ve been filling this prescription every 30 days since I was discharged from the hospital on January 10. Nothing new. Nothing changed.

Same medication. Same dosage. Same diagnosis. Same insurance.

Except this time, the pharmacy told me my insurance wouldn’t cover it.

The stated reason? Because aspirin is available over the counter.

The out-of-pocket price? $11.99.

OTC vs. Prescription: Why It Matters

When a medication is available over the counter, insurance may assume a prescription isn’t necessary. But that overlooks key realities.

A prescription:

Documents medical necessity

Aligns with clinical guidelines (especially after events like a heart attack or stent placement)

Supports consistent dosing and care coordination

May be required for $0 preventive coverage

OTC availability does not eliminate medical necessity, but insurance systems often treat it that way unless patients advocate.

Now, here’s where things get interesting.

I am at the point in the year where I have no medication copays, having already met my maximum out-of-pocket costs in April due to my heart attack, ongoing treatment for chronic iron deficiency anemia, and a diagnosis of ITP. Aspirin, in my case, is classified as preventive. While it is available over the counter, my physicians prefer that I remain on the prescribed version for both medical reasons and documentation purposes.

In other words, the denial was not about medical necessity. It was about how the medication is categorized in an insurance system that doesn’t always account for clinical context.

For patients with coronary artery disease and stents, aspirin isn’t simply preventive in the casual sense, it is foundational. It’s part of the clinical plan to reduce the risk of another cardiac event.

So instead of shrugging and paying the $11.99, I did what advocacy requires: I paused, questioned it, and picked up the phone.

“It’s Covered… But It’s Rejecting”

After getting my insurance provider on the phone, the representative confirmed what I already knew. According to my plan, this medication is covered at $0 cost as preventive care.

Yet every time they tried to process it, the claim was rejected internally.

That’s when leadership got involved.

A supervisor reviewed the formulary and confirmed, again, that the medication is covered in both 2025 and 2026. Despite that, the system still would not process the claim. The next step? A request to the claims manager, which may take up to five business days to resolve.

Five business days to resolve coverage for a medication that cardiology expects me to take daily, indefinitely, after a heart attack.

All of this, for aspirin.

Why This Matters (And Why Many People Would Give Up)

It would have been easy to pay the $11.99 and walk away. Many people would. And that is exactly how these issues persist - quietly, invisibly, and at the patient’s expense.

While $11.99 may not sound catastrophic, the issue isn’t the dollar amount. It’s the precedent. If this happens once, it can happen again. For people on fixed incomes, multiple medications, or managing serious conditions, those “small” costs add up quickly.

But this experience highlights several truths I see every day in my work:

Insurance errors happen even when coverage exists

Pharmacies rely on what the system tells them

Patients are often expected to absorb the cost or confusion

Persistence is often required to access what you are already entitled to

If you don’t know your benefits, or you don’t feel confident challenging a denial, you may never know that the problem wasn’t the coverage - it was the process.

Advocacy Is a Skill, Not a Personality Trait

This situation was not resolved because I was “lucky.” It moved forward because I understood how to advocate:

I knew my medication was classified as preventive

I understood what a formulary is and why it matters

I knew that an internal rejection didn’t automatically mean a denial

I asked for escalation when the explanation didn’t make sense

Advocacy also meant understanding the clinical importance of this medication and being unwilling to let a system rule override appropriate post–heart attack care.

Advocacy isn’t about being difficult. It’s about being informed.

It is especially critical for those of us who are managing chronic conditions, aging solo, or navigating healthcare without a built-in support system.

The Bigger Takeaway

Healthcare advocacy isn’t only for emergencies, hospitalizations, or life-altering diagnoses. It shows up in everyday moments: at the pharmacy counter, on hold with insurance, in conversations where the answer doesn’t quite add up.

Ironically, this happened well after the medical emergency was over, after the hospitalization, after the stents, after discharge, when care is supposed to be routine and stable. That’s often when advocacy matters most.

Knowing your benefits.

Understanding basic insurance language.

Asking questions.

Not accepting “that’s just how it is” as a final answer.

These are not extras. They are essential skills.

Because sometimes, the difference between $0 and $11.99 isn’t the medication, it’s the advocacy.